Revolutionizing Banking Operations: Vertify’s Seamless Integration of Marketo Engage with Multiple Salesforce or Dynamics CRMs

The financial landscape is anything but static. Mergers, acquisitions, and evolving customer demands leave banks grappling with disparate data siloed across various CRMs. This disjointed experience hinders marketing efforts and frustrates sales teams. But fear not, for Vertify is your go-to for seamlessly integrating Marketo Engage with multiple Salesforce or Dynamics CRMs, unifying customer data for a holistic banking experience.

Staying ahead of the competition requires innovative solutions that streamline operations and enhance customer engagement. This Vertify integration not only caters to the needs of large banks but also proves invaluable for smaller institutions globally. Let’s dive into a success story to understand how Vertify’s integration solution is transforming the banking experience for a North American bank that has recently undergone multiple acquisitions.

Setting the Stage

Enter the North American Titan: Imagine a prominent North American bank, “Acme Bank,” on a growth trajectory. Through strategic acquisitions, they’ve expanded their reach, but inherited a hodgepodge of CRMs – Salesforce in their legacy systems and Dynamics 365 in their new branches. This fragmented data landscape is causing serious friction, including:

- Marketing Misfires: Marketing campaigns lacked a unified view of customers, leading to irrelevant messaging and wasted resources.

- Sales Silos: Sales reps struggled to access complete customer histories, hindering personalized interactions and deal velocity.

- Operational Inefficiencies: Duplicate data entry and manual data reconciliation consumed valuable time and resources.

Acme Bank has expanded its operations significantly through a series of strategic acquisitions over the past two years. While these acquisitions have broadened the bank’s customer base and increased its market share, they have also brought about a complex web of data silos and disparate systems. The challenge lies in consolidating customer data, standardizing processes, and ensuring a seamless customer experience across all acquired entities.

You may also enjoy: How to Manage Contact Records Across Multiple CRMs

Enter Vertify and Marketo Engage

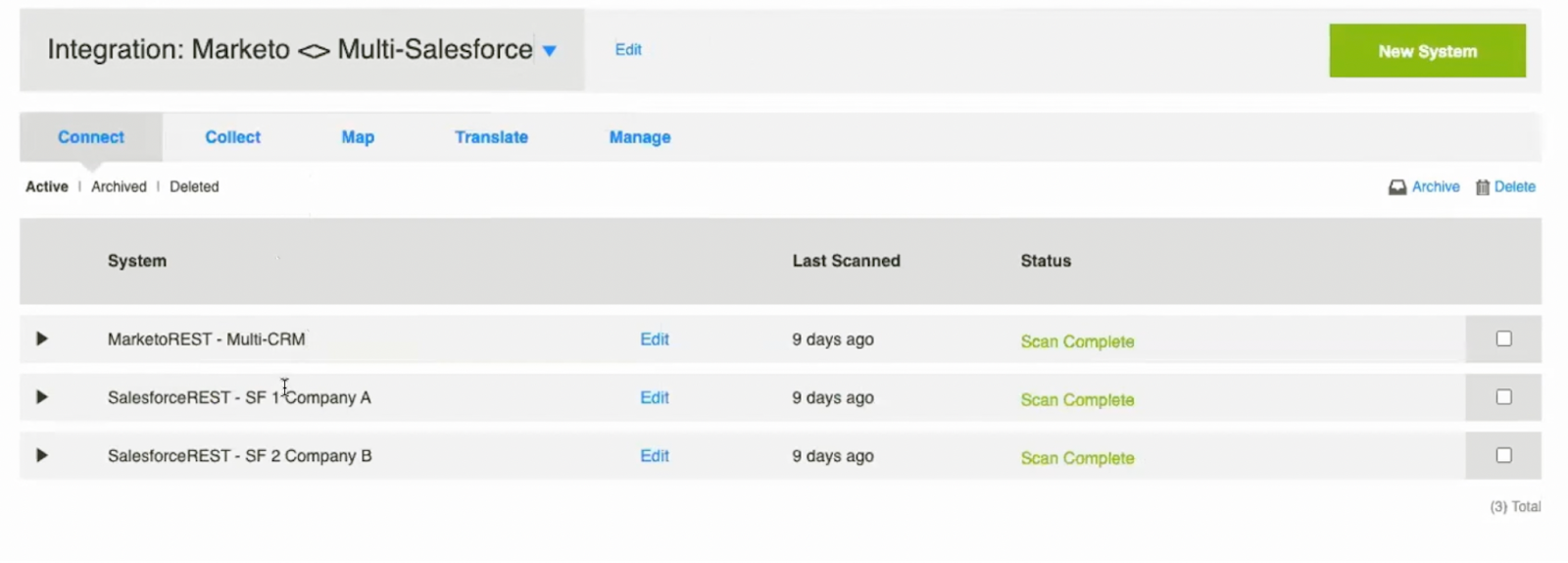

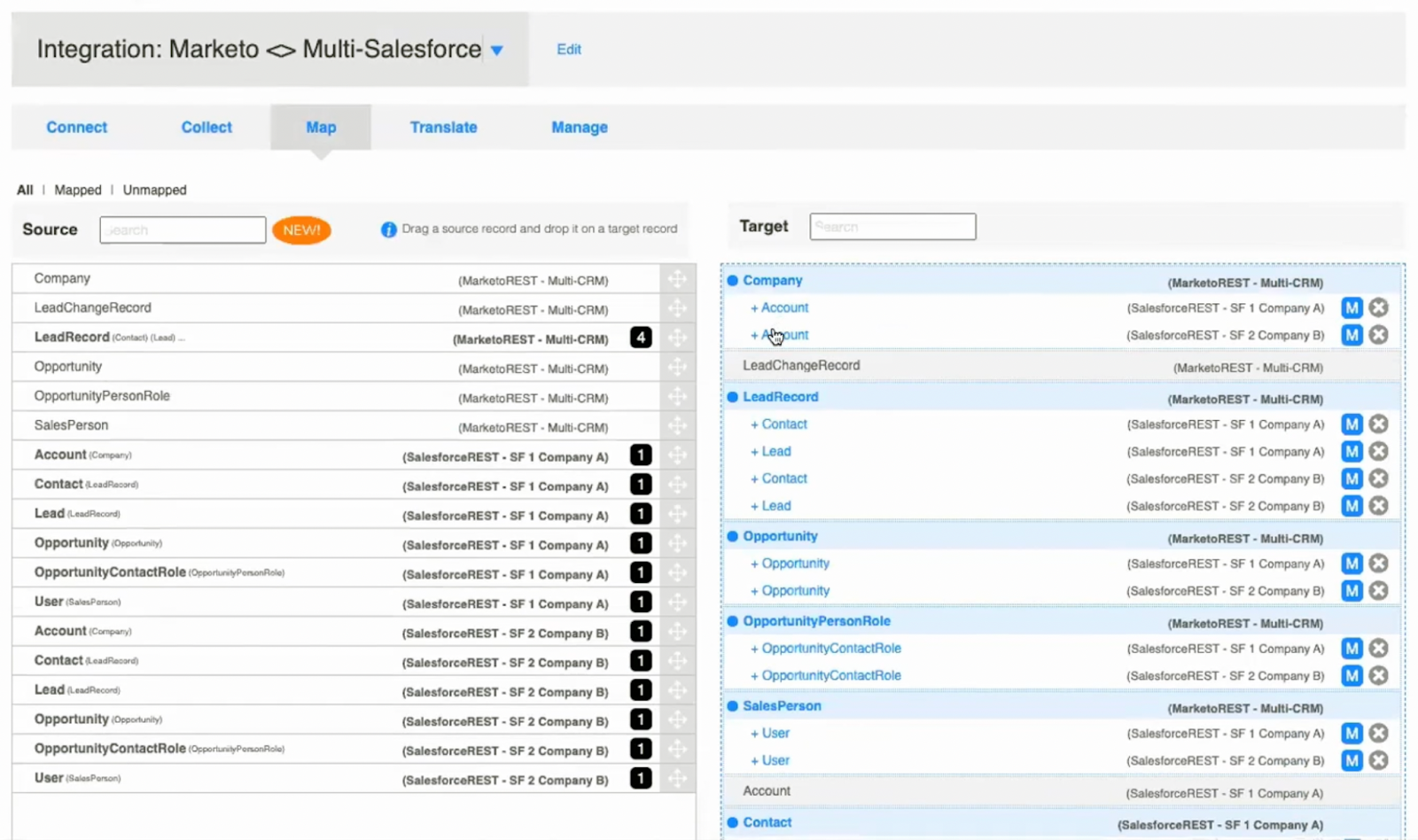

Recognizing the need for a comprehensive solution, Acme Bank turns to Vertify, a leading data integration platform. Vertify’s expertise lies in connecting disparate systems and optimizing data flow, and its rock solid partnership and integration with Marketo Engage proves to be a game-changer for the banking industry. Marketo Engage, a powerful marketing automation platform, when seamlessly integrated with multiple CRMs like Salesforce and Dynamics through Vertify, allows banks to centralize customer data, automate marketing campaigns, and gain actionable insights.

The Integration Journey

- Data Unification: Vertify bridges the gap for Acme’s Marketo Engage instance, 3 Salesforce instances, and 1 Dynamics instance, ensuring a unified customer view. This eliminates duplicate records, enhances data accuracy, and provides a 360-degree understanding of each customer’s interactions with the bank and its various divisions.

- Automated Marketing Campaigns: Leveraging the power of Marketo Engage, the bank can now design and execute targeted marketing campaigns based on customer behavior, preferences, and transaction history. This level of personalization enhances customer engagement and loyalty.

- Streamlined Sales Processes: With Salesforce and Dynamics seamlessly integrated, the bank’s sales teams experience a streamlined process. They can access up-to-date customer information, track leads more efficiently, and collaborate seamlessly across the entire organization.

The Success Story

As a result of the Vertify integration, Acme Bank witnessed remarkable improvements in key performance indicators. Customer satisfaction scores soared as personalized communications became the norm. Marketing efforts yielded higher conversion rates, and the sales teams reported increased efficiency and productivity.

The unified data view provided by Vertify allows the bank to identify cross-selling and upselling opportunities easily. The automation capabilities of Marketo Engage enable the bank to nurture leads effectively and convert them into loyal customers. The overall impact is a more agile and responsive banking institution, ready to adapt to market dynamics and customer expectations.

Result Highlights: A Game Changing Integration

- Marketing Marvels: Personalized campaigns based on a unified customer view boosted engagement and conversion rates.

- Sales Superstars: Armed with complete customer histories, sales reps closed deals faster and delivered exceptional service.

- Operational Efficiency: Automated data syncs eliminated manual tasks, freeing up resources for strategic initiatives.

You may also enjoy: Customer Story: How One Financial Services Company Mastered the Multi-CRM Challenge

Conclusion

If you are looking for a solution like Vertify and already have the conundrum of using Marketo Engage along with multiple CRM instances, you may think the simplified and trusted data hub that is Vertify is too good to be true. That could not be further from the truth, as seen by multiple banking titans across the globe.

Vertify’s integration of Marketo Engage with multiple CRMs like Salesforce and Dynamics is a testament to the transformative power of technology in the banking sector. As financial institutions continue to navigate through mergers and acquisitions, this integration proves to be an invaluable tool for achieving operational efficiency, enhancing customer experiences, and maintaining a competitive edge in the global market. The success story of Acme Bank illustrates that the future of banking is not just about acquiring customers, but about seamlessly integrating their experiences for a more connected and personalized financial journey.

At Vertify, we provide data integration ecosystems built to help your tools and employees speak to each other with straightforward data and a focus on performance. Click here to schedule a demo to see how better data integration can transform your organization.